Acts travel road to recovery

Profitable tours amp up a troubled biz

Variety

By PHIL GALLO

With record sales dipping every year and film box office flat in 2003, one area of entertainment is showing a boffo rise: North American concert revenue shot up 20% to $2.5 billion.

The concert business has had a brilliant 21st century, with improved grosses each of the past four years, and there are signs that 2004 could be the biggest 12-month period yet.

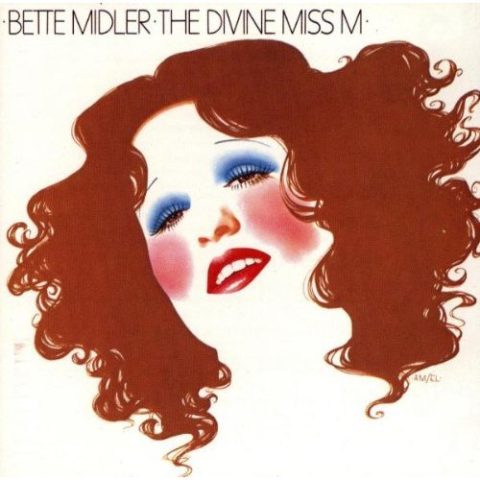

The first quarter of the year, normally a fallow period for touring, is going gangbusters, with several of last year’s holdovers: Every week, Bette Midler, Rod Stewart and Shania Twain are doing $1 million, as is the double bill of Aerosmith and Kiss; and Toby Keith (the top country attraction in 2002) is doing about a half-million.

As the movie business continues to shun a 12-month calendar, and the record industry continues to swamp the fourth quarter with high-profile releases, concert acts are willing to make the drive from Omaha, Neb., to Des Moines, Iowa, to Chicago in the dead of winter, a period usually reserved for club acts trying to break through.

New tours of large theaters that started in January and February include David Bowie, Rod Stewart, Neil Young, Kid Rock and Josh Groban; Metallica and a pairing of Alan Jackson & Martina McBride started arena tours in late January; late winter-early spring will see Britney Spears and Prince in arenas; and the Eagles will spend May in tertiary markets such as Bismarck, N.D., Rapid City, S.D., and Casper, Wyo.

Playing to about 20,000 people a night this summer will be perennial cash cows Ozzfest and the Dave Matthews Band, plus a double bill of No Doubt and Blink-182, Rush’s 30th anniversary tour and a new alt-metal package of Linkin Park, Korn and Snoop Dogg on multi-month outings.

The Dead will tour the country for a few months, appearing at June’s Bonnaroo Festival in Tennessee, and Sting and Annie Lennox will play to 15,000-plus from June through September, as will k.d. lang, who’s appearing with local symphony orchestras, and opener Rufus Wainwright.

And the prospect of a U2 tour late in the year following the release of their next album has promoters salivating, as does rumored runs from Madonna and Van Halen with Sammy Hagar.

As House of Blues Concerts exec VP Alex Hodges planned the summer season for L.A.’s Universal Amphitheater, he found more holds on dates than ever.

“Touring has increased in importance for artists to gain respect,” he says. “There’s more demand for agents to get in a position to get the best-possible dates, so I think we’re getting a bit ahead in the game.”

Industry leader Clear Channel is the first to tell anyone its business is being run smarter and more efficiently. The concert biz is not just about selling tickets: Promoters are developing new levels of sponsorships, creating secondary revenue streams and effectively making live entertainment on par with a sports playoff game.

A number of experiments have fizzled or run out of steam, and there are still some sales techniques that aren’t necessarily artist-friendly — like putting a summer’s worth of concerts on sale on one day.

“The front of the season can get hard,” notes Bert Hollman, who, since 1991, has managed the Allman Brothers Band, a consistent breadwinner among acts that make their living during the summer. “You force a fan to decide between one show or the other. It sucks a lot of money out a market.”

Still, the concert business has set an agenda of getting back to the basics of developing acts from the club level to arenas and filling amphitheaters with acts that deliver a consistent bang for the buck.

Promoters across the country predict a continuing economic recovery, and say bands are pricing themselves according to their fan bases — and have nothing too unreasonable on their contract riders.

“We went through a number of years when artists were very aggressive with their prices,” says Clear Channel music prexy Don Law. “That has begun to quiet down.”

Boston-based Law and L.A.’s Hodges have been in the concert biz for more than 30 years. Both have watched the industry transform from a regional business to a national one over the last decade and, after an influx of acts that debuted as superstars (Backstreet Boys, Ricky Martin, ‘N Sync, Eminem), a return to building careers from the ground up.

“Radio doesn’t work anymore, and the video generation has proven false,” Law says. “The acts with great videos often have no live act at all. And playing live is more important than ever.

At the end of the 1960s and beginning of the 1970s, the music business exploded, Law remembers. “There has never been another time when we’ve seen so many great acts. One week it would be the Who doing ‘Tommy’ for an audience of 750, and the next week Led Zeppelin came in. People forget that it was week after week like that.”

Over the past 10 years, hype has been accompanied by saturation strategies that, when successful, have made million-sellers of acts that would have needed several years of touring to achieve those results decades earlier.

Says Clear Channel Entertainment Chairman and CEO Brian Becker: “The good news is that artists are getting wide exposure quickly. But it also gives a false indication of staying power.”

While the stars of the last two decades have burned bright for far shorter spans than their brethren from the ’60s and ’70s, there are aspects of the concert business as old as rock ‘n’ roll itself. One is how much promoters earn.

For their first tour of the U.S., the Beatles’ price was $7,000 against 60% of the gross. Knowing the Fab Four could do only a 35-minute show, promoters would have to hire a collection of opening acts to pad the event’s running time, which pushed the point of profitability to about $25,000 (Variety, Feb. 12, 1964). “Sometimes you have to get out a magnifying glass to the promoters’ percentage,” Law says.

That limits the number of baby bands a promoter can take a risk on. And nurturing such bands traditionally has been seen by promoters as a building block to a shared success.

So in the wake of the instant superstar acts of the late 1990s, which released albums and within a year filled 60,000 seats only to struggle to attract 12,000 fans per city the next, record companies suddenly find themselves concerned with developing acts the old-fashioned way — a repetitive cycle of recording followed by touring.

And that’s music to promoters’ ears.

The logic is that acts and their management stay loyal to the promoters who stuck with them from their early days onward, although no band has ever signed a contract giving a promoter rights to future tours based on early support.

“The business used to be 80% relationships and 20% business, and now that has flipped,” says Kevin Morrow, senior VP of House of Blues Concerts.

Acts at amphitheaters, theaters that seat more than 3,000 and arenas generally take home about 65% of the gross. There are cases, such as Bruce Springsteen’s Dodger Stadium concert last year, in which the act received the entire door and the promoter’s profit came from jacked-up parking and concessions prices.

Generally, the promoter draws a profit on the difference between production and administrative costs vs. the gross, taking home the first 10% and then splitting the remainder with the act, which gets 80%-90%.

To bulk up coffers, promoters have made several attempts to generate income that the musicians can’t touch — most notably venue fees, and by getting corporate entities to sponsor buildings or series.

Clear Channel will take the sponsorship one step further this summer, offering blocks of tickets promoters don’t expect to sell at outdoor venues, and pitch them to mobile phone companies and the like.

While venues base ticket prices on anticipated attendance, outdoor summer shows often have lawn seats in abundant supply that local promoters don’t worry about selling. Becker says there’s an opportunity to convert “unsold inventory” into a profit center while putting the onus of getting the tickets into consumers hands on a third party.

“Sponsors have learned how (the concert business) works and how fans respond — they’re sensitive to not blanketing the stage” with signage, says Morrow of House of Blues, the country’s second-largest concert promotion company.

Adds Morrow, who has recently worked with Grey Goose vodka, Sony PlayStation, Volkswagen, Discover Card and Coors: “Half the tours you see wouldn’t go out without sponsorship. As labels consolidate and there’s less and less tour support, we bring together an act and a company looking to do a media spend.”

For example, the Greek Theater, a 6,000-seat outdoor venue in Los Angeles run by the Nederlander org, has five sponsors for the venue. Tours, of course, have their own separate sponsors; the first announced show at the Greek is the Honda Civic-sponsored tour of Dashboard Confessional and Thrice.

As much as sponsorship has been accepted, promoters continue to fight the ill will generated by fees associated with tickets.

“As an industry, we have made mistakes,” proffers Clear Channel’s Becker. “One is how we position ourselves to the public. I wish I could turn back time and (not introduce fees). If I have scenario A in which a ticket is $40 and the artist gets $33, I would prefer it to saying a ticket is $33, which the artist gets, and then there’s a $3 fee and $2 fee and another $3 fee.

“Forty bucks I understand. When you’re told the price of admission, example A is legitimate. In B, the economics of the producer, presenter and artist come into play. It’s irrelevant where the money is going. There are three questions for any show: Did fans get what they paid for? Was the artist compensated? Did the presenter get a fair return?”

Ever-present on the current touring scene has been the issue of Clear Channel exerting monopolistic control over not only the airwaves — it owns 1,200 radio stations — but also concert venues. No artist, though, has attempted to fight CC the way Pearl Jam battled Ticketmaster in the early 1990s, when the band, objecting to Ticketmaster’s surcharges, refused to let the ticketing giant sell its concerts.

Neil Young’s tours for his album “Greendale” last summer and this winter were booked by Clear Channel, and at one point in his show, complete with a stage play with about 30 actors, he even takes a dig at the corporate giant.

“The economics of the business are all pretty insane,” says Young’s manager, Elliot Roberts, suggesting that the music industry is run by one behemoth after another, which has cut into the quality of the music. “So Clear Channel owns all the venues. It is just another big company — it’s history repeating itself.”

And as long as most artists see full venues and healthy paydays, complaints will be kept to a minimum.